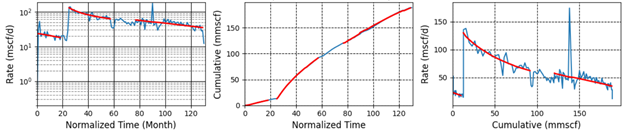

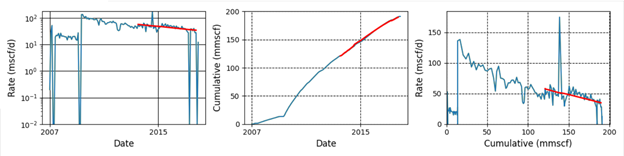

The probabilistic forecast (beta) starts with a decline fit, similar to the traditional Arps decline in Harmony Enterprise. Shut-ins and outliers are removed, and the data is divided into partitions of distinct rate trends.

The partition at the end of the production history is fit to determine a decline forecast as a starting point.

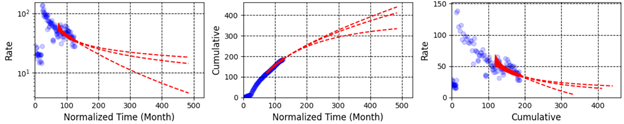

The qi, Di, and b from this initial fit become the starting point for distributions for additional forecasts. The b is sampled evenly across the range defined by the minimum and maximum specified in the Options dialog box. The qi is sampled in the range around the best-fit result. However, rather than independently sampling Di values, the decline equation is used to determine the relationship between inputs, so that Di can be calculated from each qi, b pair.

The decline forecast for each of these parameter sets is calculated. The quality of fit is then assessed and only good matches are kept.

This collection of forecasts is then sorted and the percentiles specified in the Options dialog box are calculated. Since a consistent approach is used in determining qi and b, and the relationship to Di, the results from this method are reproducible.

Note: Harmony Enterprise uses the reserves evaluation convention for percentiles, which is the inverse of the statistical percentiles traditionally used. For example, a P90 represents the 10th percentile in statistical terms, where 10% of the set is less than this value, and 90% is greater than this value. Harmony Enterprise converts the input percentiles into the correct statistical version for calculation purposes.